You can call us at 020 7933 2626

You can call us at 020 7933 2626

Last updated: 08 November 2018

Checkmate is a division of Lockton Companies LLP.

Lockton Companies LLP is committed to protecting the privacy and security of your personal data.

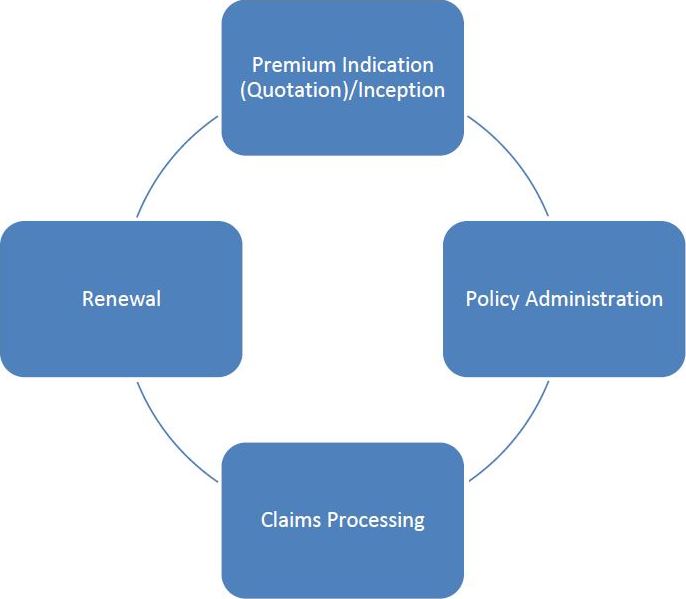

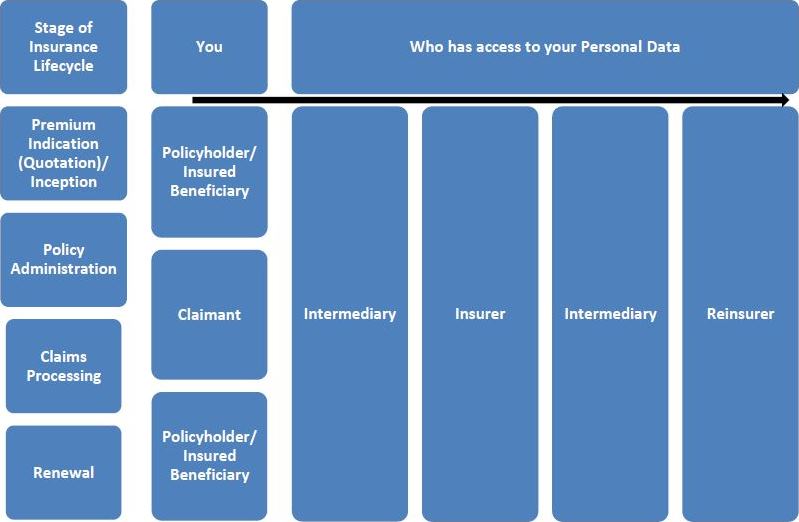

Checkmate provides new home and building warranty insurance acting as agent of the insurers, under a delegated authority granted to Checkmate by insurers. This means that Checkmate has been given authority by insurers to perform a range of services on their behalf. This notice describes how we collect and use personal data about you during the provision of these services, in accordance with the Data Protection Laws. In particular this notice is designed to help you understand how we process your personal data through the insurance lifecycle. Insurance is the pooling and sharing of risk in order to provide protection against a possible eventuality. In order to do this, information, including your personal data, needs to be shared between different insurance market participants. The insurance market is committed to safeguarding that information.

This notice also aims to give you information on how Lockton Companies LLP collects and processes your personal data through your use of this website, including any data you may provide through this website, for example when you sign up to our newsletter or fill in our contact us form, or claims form. In particular, this notice, together with the Terms of Use and Cookies Notice sets out how we look after your personal data when you visit our website (regardless of where you visit it from) and tells you about your privacy rights and how the law protects you.

Lockton is committed to protecting the privacy needs of children and encourages parents and guardians to take an active role in their children’s online activities and interests. Lockton does not intentionally collect information from children, and Lockton does not target its website to children.

It is important that you read this notice, together with any other privacy notice we may provide on specific occasions when we are collecting or processing personal data about you, so that you are aware of how and why we are using such information. This privacy notice supplements the other notices and is not intended to override them.

Insurance involves the use and disclosure of your personal data by various insurance market participants such as intermediaries, insurers and reinsurers. The London Insurance Market has produced a Core Uses Information Notice (LMA Notice) which sets out those core necessary personal data uses and disclosures throughout the insurance lifecycle, and in particular sets out how other insurance market participants process your personal data. Our core uses and disclosures are consistent with the LMA Notice. In addition to reviewing our privacy notice, we recommend you review the LMA Notice. As at the time of publishing this notice the LMA Notice can be found on the LMA website (www.lmalloyds.com) at: http://lma.informz.ca/LMA/data/images/Bulletin%20att/LMA17_038_MS_att1_information_notice.pdf Please note that we do not control the LMA website and are not responsible for the London Insurance Market Core Uses Information Notice.

Lockton Companies LLP is a data controller”. This means that we are responsible for deciding how we hold and use personal data about you. We are required under the Data Protection Laws to notify you of the information contained in this privacy notice.

We have appointed a data protection manager to oversee compliance with and questions in relation to this privacy notice.

If you have any questions about this privacy notice, including any requests to exercise your legal rights, please contact our Data Protection Manager using the details set out below:

Data Protection Manager

Lockton Companies LLP, trading as Checkmate

The St Botolph Building

138 Houndsditch

London

EC3A 7AG

Email: dataprotection@uk.lockton.com

This notice may be updated from time to time. We encourage you to review this notice regularly when you visit our website to learn more about how we are using your personal data and safeguarding your privacy. This version is dated 08 November 2018 and historic versions can be obtained by contacting our Data Protection Manager.

It is important that the personal data we hold about you is accurate and current. Please keep us informed if your personal data changes during your relationship with us.

Our website may, from time to time, contain links to and from third-party websites, plug-ins and applications, including without limitation websites of our partner networks and affiliates. Clicking on those links may allow third parties to collect or share data about you. Please note that these third-party websites have their own privacy notices and we do not control those websites or accept any responsibility or liability for these privacy notices. When you leave our website, we encourage you to read the privacy notice of every website you visit. This notice is specific to our website.

In this notice:

we, us or our refers to Checkmate, a division of Lockton Companies LLP, a limited liability partnership with company number OC353198 and its registered office at The St Botolph Building, 138 Houndsditch, London, EC3A 7AG, an independent insurance and reinsurance intermediary authorised and regulated in the United Kingdom by the Financial Conduct Authority (FCA) under Firm Reference Number 523069;

you or your, refers to the individual whose personal data may be processed by us and other insurance market participants (you may be a potential or actual policyholder, insured, beneficiary under a policy, their family member, claimant or other person involved in a claim or relevant to a policy).

There are other terms in bold with specific meanings. Those meanings can be found in Section 11: Glossary of Key Terms.

Contents of this privacy notice

This notice is provided in a layered format so you can click through to the specific areas sets out below:

1 – INTRODUCTION – HOW THE INSURANCE MARKET WORKS

2 – THE DATA WE MAY COLLECT ABOUT YOU (YOUR PERSONAL DATA)

3 – WHERE WE MIGHT COLLECT YOUR PERSONAL DATA FROM

4 – THE PURPOSES, CATEGORIES, LEGAL GROUNDS AND RECIPIENTS, OF OUR PROCESSING OF YOUR PERSONAL DATA

6 – PROFILING AND AUTOMATED DECISION MAKING

8 – RETENTION OF YOUR PERSONAL DATA

10 – YOUR RIGHTS AND CONTACT DETAILS OF THE ICO

SECTION 1: INTRODUCTION – HOW THE INSURANCE MARKET WORKS

SECTION 2: THE DATA WE MAY COLLECT ABOUT YOU (YOUR PERSONAL DATA)

In order for us to obtain premium indications, place and administer insurance policies, and/or deal with any claims or complaints, we need to collect and process personal data about you.

The types of personal data that are processed may include:

| Types of Personal Data: | Details: |

| Individual details ? | Name, address (including proof of address), other contact details (e.g. email and telephone numbers), gender, marital status, date and place of birth, nationality, employer, job title and employment history, and family details, including their relationship to you |

| Identification details ? | Identification numbers issued by government bodies or agencies, including your national insurance number and passport number |

| Financial information ? | Bank account or payment card details, income or other financial information |

| Risk details ? | Information about you which we need to collect in order to assess the risk to be insured and provide a premium indication. This may include data relating to your criminal convictions |

| Policy information ? | Information about the premium indications you receive and policies you take out |

| Credit and anti-fraud data ? | Credit history, credit score, sanctions and criminal offences, and information received from various anti-fraud and sanctions databases, or regulators or law enforcement agencies relating to you |

| Previous and current claims ? | Information about previous and current claims, (including other unrelated insurances),which may include data relating to your criminal convictions |

| Special categories of personal data ? | Certain categories of personal data which have additional protection under the GDPR. The categories are : (a) criminal convictions, (b) religious or philosophical beliefs, or data concerning sex life or sexual orientation, which we may inadvertently capture (e.g. through use of title, family details and relationship to data subject) |

| Technical data ? | internet protocol (IP) address, browser type and version, time zone setting and location, browser plug-in types and versions, operating system and platform and other technology on the devices you use to access this website |

| Usage data ? | Information about how you use our website, products and services, including information from your visit from cookies, such as clickstream to, through and from our website (including date and time), items you viewed or searched for, page response times, download errors, length of visits to certain pages, page interaction information (such as clicks), and methods used to browse away from the page |

| Marketing and communications data ? | Your preference in receiving marketing from us and third parties and your communication preferences |

Personal data does not include data where the identity has been removed (anonymous data).

We also collect, use and share aggregated data such as statistical or demographic data for any purpose. Aggregated data may be derived from your personal data but is not considered personal data in law as this data does not directly or indirectly reveal your identity. However, if we combine or connect aggregated data with your personal data so that it can directly or indirectly identify you, we treat the combined data as personal data which will be used in accordance with this privacy notice.

If you fail to provide personal data

Where we need to collect personal data by law, or under the terms of a contract we have with you and you fail to provide that data when requested, we may not be able to provide the services. In this case, we may have to cancel a service you have with us but we will notify you if this is the case at the time.

SECTION 3: WHERE WE MIGHT COLLECT YOUR PERSONAL DATA FROM

We might collect your personal data from various sources, including:

Which of the above sources apply will depend on your particular circumstances.

For example, we might collect your personal data where:

SECTION 4: THE PURPOSES, CATEGORIES, LEGAL GROUNDS AND RECIPIENTS, OF OUR PROCESSING OF YOUR PERSONAL DATA

We set out below the purposes for which we might use your personal data:

| Purposes: | |

| Relationship Management | To provide you with information (for example in respect of products and services) that you request from us, and taking steps at your request prior to entering into a contract |

| Membership / Premium Indication / Inception | Setting you up as a member, including possible fraud, sanctions, credit and anti-money laundering checks Evaluating the risks to be covered and matching to appropriate insurer/policy/premium Payment of premium where the insured/policyholder is an individual |

| Policy Administration | Communicating with you and sending you updates regarding your membership Payments to and from individuals |

| Claims Processing | Managing insurance claims Defending or prosecuting legal claims Investigation or prosecuting fraud |

| Membership Reviews | Contacting the member to renew membership |

| Other purposes outside of the insurance lifecycle but necessary for the provision of insurance throughout the insurance lifecycle period | Complying with our legal and regulatory obligations General risk modelling Transferring books of business, company sales and reorganisations |

| Website Management | To administer and protect our business and this website and for internal operations, including to keep our website safe and secure, data analysis, troubleshooting, testing, system maintenance, support, reporting and hosting of data, research, statistical and survey purposes To use data analytics to improve our website, products/services, marketing, customer relationships and experiences, including to ensure that content from our website is presented in the most effective manner for you and for your device |

| Marketing | To make suggestions and recommendations to you about products or services that may be of interest to you, to provide industry insight or to invite you to events To measure and understand the effectiveness of marketing we serve to you and others and to deliver relevant marketing to you |

Please note that in addition to the disclosures we have identified against each purpose, we may also disclose personal data for those purposes to our service providers, contractors, agents and group companies that perform activities on our behalf.

MARKETING

We strive to provide you with choices regarding certain personal data uses, particularly around marketing and advertising. We have established the following personal data control mechanisms:

Marketing communications from us

We may use your Individual Details and Policy Information to form a view on what we think you may want or need, or what may be of interest to you. This is how we decide which products, services, events and industry insight may be relevant for you.

You will receive marketing communications from us if you have requested information from us (including for example where you have provided your explicit consent by way of opting-in to receiving our marketing communications in accordance with applicable law) or purchased services from us, or (where you are a corporate entity) where we consider the marketing material to be relevant to you and, in each case, you have not opted out of receiving that marketing. Such marketing communications may include risk or insurance related information or details of services, or products, or events, which we think, may be of interest to you.

Third party marketing

We will get your express opt-in consent before we share your personal data with any company outside the Lockton group of companies for marketing purposes.

We may share your personal data with other companies in the Lockton group of companies, if allowed and appropriate, for marketing purposes.

Managing your Marketing Preference (including Opting out)

You can manage your marketing preferences or ask us or third parties to stop sending you marketing messages at any time by following the opt-out links on any marketing message sent to you or by contacting our Data Protection Manager at any time.

Where you opt out of receiving these marketing messages, this will not apply to personal data provided to us as a result of a product/service purchase, product/service experience or other transactions, and will not affect communications relating to any such matters on which we are advising you.

COOKIES

You can set your browser to refuse all or some browser cookies, or to alert you when websites set or access cookies. If you disable or refuse cookies, please note that some parts of this website may become inaccessible or not function properly. For more information about the cookies we use, please see our Cookies Notice.

CHANGE OF PURPOSE

We will only use your personal data for the purposes for which we collected it, unless we reasonably consider that we need to use it for another reason and that reason is compatible with the original purpose. If you wish to get an explanation as to how the processing for the new purpose is compatible with the original purpose, please contact our Data Protection Manager.

If we need to use your personal data for an unrelated purpose, we will notify you and we will explain the legal basis which allows us to do so.

Please note that we may process your personal data without your knowledge or consent, in compliance with the above rules, where this is required or permitted by law.

We will only use your personal data when the law allows us to. In particular, we will rely on the following legal grounds to use your personal data:

| For processing personal data and special categories of personal data | |

| Legal ground | Details |

| Your explicit consent (optional) | You have given your explicit consent to the processing of those personal data for one or more specified purposes. You are free to withdraw your consent, by contacting our Data Protection Manager |

| Performance of our contract with you | Processing is necessary for the performance of a contract to which you are party or in order to take steps at your request prior to entering into a contract |

| Compliance with a legal obligation | Processing is necessary for compliance with a legal obligation to which we are subject |

| In the public interest | Processing is necessary for the performance of a task carried out in the public interest |

| For our legitimate business interests | Processing is necessary for the purposes of the legitimate interests pursued by us or by a third party, except where such interests are overridden by your interests or fundamental rights and freedoms which require protection of personal data, in particular where you are a child. These legitimate interests are set out next to each purpose below |

| For processing special categories of personal data | |

| Your explicit consent (optional) | You have given your explicit consent to the processing of those personal data for one or more specified purposes. You are free to withdraw your consent, by contacting our Data Protection Manager |

| Your explicit consent (necessary) | You have given your explicit consent to the processing of those personal data for one or more specified purposes, where we are unable to procure, provide or administer insurance cover without this consent. You are free to withdraw your consent by contacting our Data Protection Manager. However withdrawal of this consent will impact our ability to place or administer insurance or assist with the payment of claims. For more detail see Section 5: Consent |

| For legal claims | Processing is necessary for the establishment, exercise or defence of legal claims or whenever courts are acting in their judicial capacity |

| In the substantial public interest | Processing is necessary for reasons of substantial public interest, on the basis of EU or UK law |

We may have to share your personal data with the parties set out below for the Purposes set out in the table above.

We have set out below, in a table format, a description of all the ways we plan to use your personal data, including the categories of personal data and which of the legal bases we rely on to do so. We have also identified what our legitimate interests are where appropriate, and the third parties with whom we need to share your personal data.

Note that we may process your personal data for more than one lawful ground depending on the specific purpose for which we are using your personal data. Please contact our Data Protection Manager if you need details about the specific legal ground we are relying on to process your personal data where more than one ground has been set out in the table below.

| Purpose | Categories of Data | Legal Grounds | Disclosures |

RELATIONSHIP MANAGEMENTTo provide you with information (for example in respect of products and services) that you request from us, and taking steps at your request prior to entering into a contract |

Personal Data: - Individual details - Marketing and Communications Data |

Personal Data: - Performance of our contract with you - Compliance with a legal obligation - For our legitimate business interests (to correspond with you) |

|

MEMBERSHIP/ PREMIUM INDICATION/ INCEPTIONSetting you up as a member, including fraud, sanctions, credit and anti-money laundering checks |

Personal Data: - Individual details - Identification details - Financial information Special Categories of Personal Data: - Credit and anti-fraud data |

Personal Data: - Performance of contract - Compliance with a legal obligation - For our legitimate business interests (to ensure that the member is within our acceptable risk profile) - To assist with the prevention of crime and fraud Special Categories of Personal Data: - In the substantial public interest - Consent |

- Credit reference agencies - Anti-fraud and sanctions databases |

MEMBERSHIP/ PREMIUM INDICATION/ INCEPTIONEvaluating the risks to be covered and matching to appropriate insurer/policy/premium |

Personal Data: - Individual details - Identification details - Policy information Special Categories of Personal Data: - Risk details - Previous claims - Credit and anti-fraud checks |

Personal Data: - Performance of our contract with you - For our legitimate business interests (to determine the likely risk profile and appropriate insurer and insurance product) Special Categories of Personal Data: - Consent |

- Other insurance market participants such as intermediaries, insurers and reinsurers |

MEMBERSHIP/ PREMIUM INDICATION/ INCEPTIONand POLICY ADMINISTRATION Payments to and from individuals, including collection or refunding of premiums, paying on claims, and processing other payments |

Personal Data: - Individual details - Financial information |

Personal Data: - Performance of our contract with you - For our legitimate business interests (to recover debts due to us, and ensuring our members are able to meet their financial obligations) |

- Other insurance market participants such as intermediaries, insurers and reinsurers - Banks |

| POLICY ADMINISTRATION Communication with you regarding your membership and requested changes to the insurance policy. Sending you updates regarding your insurance policy. Notifying you about changes to our terms or privacy notice |

Personal Data: - Individual details - Policy information Special Categories of Personal Data: - Risk details - Previous claims - Current claims |

Personal Data: - Performance of contract - For our legitimate business interests (to correspond with members, beneficiaries and claimants in order to facilitate the placing of and claims under insurance policies) - Compliance with a legal obligation - Consent Special Categories of Personal Data: - Consent - Substantial public interest |

- Other insurance market participants such as intermediaries, insurers and reinsurers |

| CLAIMS PROCESSING Managing insurance claims including fraud, credit and anti-money laundering and sanctions checks |

Personal Data: - Individual details - Identification details - Financial information - Policy information Special Categories of Personal Data: - Credit and anti-fraud data - Risk details - Previous claims - Current claims |

Personal Data: - Performance of contract - For our legitimate business interests (to assist our clients in assessing and making claims) Special Categories of Personal Data: - Consent - For legal claims - Substantial public interest |

- Other insurance market participants such as intermediaries, insurers and reinsurers - Claims handlers - Solicitors - Loss adjustors - Experts - Third parties involved in the claim |

| CLAIMS PROCESSING Defending or prosecuting legal claims |

Personal Data: - Individual details - Identification details - Financial information - Policy information Special Categories of Personal Data: - Credit and anti-fraud data - Risk details - Previous claims - Current claims |

Personal Data: - Performance of contract - For our legitimate business interests (to assist in assessing and making claims) Special Categories of Personal Data: - Consent - For legal claims |

- Other insurance market participants such as intermediaries, insurers and reinsurers - Claims handlers - Solicitors - Loss adjustors - Experts - Third parties involved in the claim |

| CLAIMS PROCESSING Investigating and prosecuting fraud |

Personal Data: - Individual details - Identification details - Financial information - Policy information Special Categories of Personal Data: - Criminal records data - Other sensitive data - Credit and anti-fraud data - Risk details - Previous claims - Current claims |

Personal Data: - Performance of contract - For our legitimate business interests (to assist with the prevention and detection of fraud) Special Categories of Personal Data: - Consent - For legal claims - In the substantial public interest |

- Solicitors - Police - Experts - Third parties involved in the investigation or prosecution - Other insurance market participants such as intermediaries, insurers and reinsurers - Anti-fraud databases |

| MEMBERHIP REVIEWS Contacting the member to renew the membership |

Personal Data: - Individual details - Policy information Special Categories of Personal Data: - Risk details - Previous claims - Current claims |

Personal Data: - Performance of contract - For our legitimate business interests (to correspond with members, beneficiaries and claimants in order to facilitate the placing of and claims under insurance policies) Special Categories of Personal Data: - Consent |

- Other insurance market participants such as intermediaries, insurers and reinsurers |

| THROUGHOUT THE INSURANCE LIFECYCLE Transferring books of business, company sales and reorganisations. To administer and protect our business |

Personal Data: - Individual details - Identification details - Financial information - Policy information - Marketing and communications data Special Categories of Personal Data: - Credit and anti-fraud data - Risk details - Previous claims - Current claims |

Personal Data: - For our legitimate business interests (for running our business, provision of administration and IT services, network security, to prevent fraud, and to structure our business appropriately) - Compliance with a legal obligation Special Categories of Personal Data: - Consent - In the substantial public interest |

- Group companies - Courts - Purchaser (potential and actual) |

| THROUGHOUT THE INSURANCE LIFECYCLE General risk modelling and underwriting |

Personal Data: - Individual details - Identification details - Financial information - Policy information Special Categories of Personal Data: - Credit and anti-fraud data - Risk details - Previous claims - Current claims |

Personal Data: - For our legitimate business interests (to build risk models that allow placing of risk with appropriate insurers) Special Categories of Personal Data: - Consent |

|

| THROUGHOUT THE INSURANCE LIFECYCLE Complying with our legal or regulatory obligations |

Personal Data: - Individual details - Identification details - Financial information - Policy information - Marketing and communications data Special Categories of Personal Data: - Credit and anti-fraud data - Risk details - Previous claims - Current claims |

Personal Data: - Compliance with a legal obligation Special Categories of Personal Data: - Consent - For legal claims - In the substantial public interest |

- PRA, FCA, ICO and other regulators - Police - Other insurance market participants such as intermediaries, insurers and reinsurers (under court order) - Insurance Fraud database - Auditors |

| WEBSITE MANAGEMENT To administer and protect this website and for internal operations, including to keep our website safe and secure, data analysis, troubleshooting, testing, system maintenance, support, reporting and hosting of data, research, statistical and survey purposes |

Personal Data: - Individual Details - Technical Data - Marketing and Communications Data |

Personal Data: - For our legitimate business interests (for running our business, provision of administration and IT services, network security, to prevent fraud and in the context of business reorganisation or group restructuring exercise) - Compliance with a legal obligation |

- Internal third parties - External third party service providers who provide IT and system administration services - Purchaser - Courts - FCA, ICO and other regulators - Police - Professional advisers |

| WEBSITE MANAGEMENT To use data analytics to improve our website, products/services, marketing, customer relationships and experiences, including to ensure that content from our website is presented in the most effective manner for you and for your device |

Personal Data: - Technical Data - Usage Data |

Personal Data: - For our legitimate business interests (to define types of customers for our products and services, to keep our website updated and relevant, to develop our business and to inform our marketing strategy) |

- External third party service providers who provide IT and system administration services |

| MARKETING To make suggestions and recommendations to you about products, services or events that may be of interest to you and to provide industry insight |

Personal Data: - Individual details - Policy information - Technical Data - Usage Data - Marketing and Communications Data |

Personal Data: - For our legitimate interests (to develop our products/services and grow our business) - Explicit consent (optional) (where required by law) |

|

| MARKETING To measure and understand the effectiveness of marketing we serve to you and others and to deliver relevant marketing to you |

Personal Data: - Individual Details - Marketing and Communications Data - Technical Data - Usage Data |

Personal Data: - For our legitimate business interests (to understand how customers use our products and services, to develop them and grow our business, and to inform our marketing strategy) |

SECTION 5: CONSENT

In order to arrange and provide insurance cover and deal with insurance claims in certain circumstances we and other insurance market participants may need to process your special categories of personal data, such as medical and criminal convictions records, as set out against the relevant purpose.

Your consent to this processing may be necessary for us and the other insurance market participants to achieve this.

You may withdraw your consent to such processing at any time. However, if you withdraw your consent this will impact our, and the other insurance market participants’, ability to place, administer and provide insurance or pay claims.

SECTION 6: PROFILING AND AUTOMATED DECISION MAKING

When calculating insurance premiums insurance market participants may compare your personal data against industry averages. Your personal data may also be used to create the industry averages going forwards. This is known as profiling and is used to ensure premiums reflect risk.

Profiling may also be used by insurance market participants to assess information you provide to understand fraud patterns. Where special categories of personal data are relevant, such as medical history for life insurance or past motoring convictions for motor insurance, your special categories of personal data may also be used for profiling. Insurance market participants might make some decisions based on profiling and without staff intervention (known as automatic decision making). Insurance market participants will provide details of any automated decision making they undertake without staff intervention in their information notices and upon request including:

SECTION 7: DATA SECURITY

Unfortunately, the transmission of data over the internet or any website cannot be guaranteed to be completely secure from intrusion. However, we have put in place appropriate physical, electronic and procedural security measures to prevent your personal data from being accidentally lost, used or accessed in an unauthorised way, altered or disclosed.

We have put in place procedures to deal with any suspected personal data breach and will notify you and any applicable regulator of a breach where we are legally required to do so.

SECTION 8: RETENTION OF YOUR PERSONAL DATA

We will keep your personal data only for so long as is necessary and for the purpose for which it was originally collected. In particular, for so long as there is any possibility that either you or we may wish to bring a legal claim under or in relation to your insurance, or where we are required to keep your personal data due to legal, regulatory, accounting or reporting reasons.

To determine the appropriate retention period for personal data, we consider the amount, nature, and sensitivity of the personal data, the potential risk of harm from unauthorised disclosure of your personal data, the purposes for which we process your personal data and whether we can achieve those purposes through other means, and the applicable legal requirements.

In some circumstances you can ask us to delete your personal data: see Section 10 (Your Rights and Contact Details of the ICO) below.

In some circumstances we may anonymise your personal data (so that it can no longer be associated with you) for research or statistical purposes in which case we may use this information indefinitely without further notice to you.

SECTION 9: INTERNATIONAL TRANSFERS

We may need to transfer your data to insurance market participants or other companies within the Lockton group or their respective affiliates or sub-contractors which are located outside of the European Economic Area (EEA). Those transfers would always be made in compliance with the GDPR.

If you would like further details of how your personal data would be protected if transferred outside the EEA, please contact our Data Protection Manager.

SECTION 10: YOUR RIGHTS AND CONTACT DETAILS OF THE ICO

If you have any questions about this privacy notice or in relation to our use of your personal data, you should first contact our Data Protection Manager. Under certain conditions, you may have the right to require us to:

In certain circumstances, we may need to restrict the above rights in order to safeguard the public interest (e.g. the prevention or detection of crime) and our interests (e.g. the maintenance of legal privilege).

If you wish to exercise any of the rights set out above, please contact our Data Protection Manager.

No fee usually required

You will not have to pay a fee to access your personal data (or to exercise any of the other rights). However, we may charge a reasonable fee if your request is clearly unfounded, repetitive or excessive. Alternatively, we may refuse to comply with your request in these circumstances.

What we may need from you

We may need to request specific information from you to help us confirm your identity and ensure your right to access your personal data (or to exercise any of your other rights). This is a security measure to ensure that personal data is not disclosed to any person who has no right to receive it. We may also contact you to ask you for further information in relation to your request to speed up our response.

Time limit to respond

We try to respond to all legitimate requests within one month. Occasionally it may take us longer than a month if your request is particularly complex or you have made a number of requests. In this case, we will notify you and keep you updated.

Your Right to Complain to the ICO

If you are not satisfied with our use of your personal data or our response to any request by you to exercise any of your rights in

We would, however, appreciate the chance to deal with your concerns before you approach the ICO so please contact us in the first instance.

| England | Scotland | Wales | Northern Ireland |

| Information Commissioner’s Office Wycliffe House Water Lane Wilmslow Cheshire SK9 5AF |

Information Commissioner’s Office 45 Melville Street Edinburgh EH3 7HL |

Information Commissioner’s Office 2nd Floor Churchill House Churchill Way Cardiff CF10 2HH |

Information Commissioner’s Office 3rd Floor 14 Cromac Place Belfast BT7 2JB |

| Tel: 0303 123 1113 (local rate) or 01625 545 745 (national rate) |

Tel: 0131 244 9001 | Tel: 029 2067 8400 | Tel: 0303 123 1114 (local rate) or 028 9027 8757 (national rate) |

| Email: casework@ico.org.uk | Email: scotland@ico.org.uk | Email: wales@ico.org.uk | Email: ni@ico.org.uk |

SECTION 11: GLOSSARY OF KEY TERMS

Key insurance terms:

Beneficiary is an individual or a company that an insurance policy states may receive a payment under the insurance policy if an insured event occurs. A beneficiary does not have to be the insured/policyholder and there may be more than one beneficiary under an insurance policy.

Claimant is either a beneficiary who is making a claim under an insurance policy or an individual or a company who is making a claim against a beneficiary where that claim is covered by the insurance policy.

Claims processing is the process of handling a claim that is made under an insurance policy.

Inception is when the insurance policy starts.

Insurance is the pooling and transfer of risk in order to provide financial protection against a possible eventuality. There are many types of insurance. The expression insurance may also mean reinsurance.

Insurance policy is a contract of insurance between the insurer and the insured/policyholder.

Insurance market participant(s) or participants: is an intermediary, insurer or reinsurer.

Insured/policyholder is the individual or company in whose name the insurance policy is issued. A potential insured/policyholder may approach an intermediary to purchase an insurance policy or they may approach an insurer directly or via a price comparison website.

Insurers: (sometimes also called underwriters) provide insurance cover to insured/policyholders in return for premium. An insurer may also be a reinsurer.

Intermediaries help policyholders and insurers arrange insurance cover. They may offer advice and handle claims. Many insurance and reinsurance policies are obtained through intermediaries.

Policy administration is the process of administering and managing an insurance policy following its inception.

Premium is the amount of money to be paid by the insured/policyholder to the insurer in the insurance policy.

Premium Indication is the process of providing a premium indication to a potential insured/policyholder for an insurance policy.

Renewal is the process of the insurer under an insurance policy providing a premium indication to the insured/policyholder for a new insurance policy to replace the existing one on its expiry.

Reinsurers provide insurance cover to another insurer or reinsurer. That insurance is known as reinsurance.

We, us or our refers to Lockton Companies LLP, a limited liability partnership with company number OC353198 and its registered office at The St Botolph Building, 138 Houndsditch, London, EC3A 7AG, an independent insurance and reinsurance intermediary authorised and regulated in the United Kingdom by the Financial Conduct Authority (FCA) under Firm Reference Number 523069.

You or your refers to the individual whose personal data may be processed by us and other insurance market participants. You may be the insured, beneficiary, claimant or other person involved in a claim or relevant to an insurance policy.

Key data protection terms:

Data Protection Laws means all laws and regulations relating to the Processing of Personal Data, including the GDPR, as the same may be in force from time to time.

GDPR is the EU General Data Protection Regulation and the new UK Data Protection Act 2018, which replaces the UK Data Protection Act 1998 from 25 May 2018.

Data Controller is an entity which collects and holds personal data. It decides what personal data it collects about you and how that personal data is used.

Information Commissioner’s Office (ICO) is the regulator (or National Competent Authority/Data Protection Authority) for data protection matters in the UK.

Personal Data is any data from you which can be identified and which relates to you. It may include data about any claims you make.

Processing of personal data includes collecting, using, storing, disclosing or erasing your personal data.

v. 2.08062018